CONTRIBUTION OF ENVIRONMENT, SOCIAL, GOVERNANCE AND FINANCIAL PERFORMANCE TO FIRM VALUE

Abstract

Keywords

Full Text:

PDFReferences

Afifah, Sintia Nur, and Nurul Fauziyyah, ‘Dampak Resesi 2023 Terhadap Harga Saham Di Indonesia’, MIZANIA: Jurnal Ekonomi Dan Akuntansi, 3.1 (2023), 292–99

Agustin, Lia, and Muhadjir Anwar, ‘Pengaruh Keputusan Investasi, Kebijakan Dividen Dan Likuiditas Terhadap Nilai Perusahaan Pada Perusahaan Sub Sektor Property Dan Real Estat Yang Terdaftar Di Bei’, Jurnal Ilmiah MEA (Manajemen, Ekonomi, Dan Akuntansi), 6.2 (2022), 1251–67

Alsayegh, Maha Faisal, Rashidah Abdul Rahman, and Saeid Homayoun, ‘Corporate Economic, Environmental, and Social Sustainability Performance Transformation through ESG Disclosure’, Sustainability (Switzerland), 12.9 (2020)

Amelia, Risa, and Ferikawita M. Sembiring, ‘Analisis Current Ratio, Return on Assets, Dan Ukuran Perusahaan, Serta Pengaruhnya Terhadap Nilai Perusahaan Yang Dimediasi Oleh Struktur Modal’, Coopetition : Jurnal Ilmiah Manajemen, 14.2 (2023), 333–48

Astuti, Ni Komang Nilawati, Ni Luh Putu Sri Purnama Pradnyani, and Putu Aristya Adi Wasita, ‘Pengaruh Penerapan Green Accounting, Profitabilitas, Dan Corporate Social Responsibility Terhadap Nilai Perusahaan’, Journal Research of Accounting (JARAC), 4.2 (2023)

BBC News Indonesia, ‘KLHK Hentikan Kegiatan Empat Perusahaan Penyebab Polusi Udara, Warga Marunda:’Kenapa Baru Sekarang?’’, BBC News Indonesia, 2023

CRI (Climate Rights International), ‘Indonesia: Proyek Nikel Raksasa Menyebabkan Kerusakan Lingkungan, Iklim, Pelanggaran HAM Masyarakat Adat, Penduduk Lokal Menghadapi Ancaman, Penyerobotan Lahan, Polusi Udara Dan Air’, CRI (Climate Rights International), 2024

Crippa, M., D. Guizzardi, F. Pagani, M. Banja, M. Muntean, E. Schaaf, and others, GHG EMISSIONS OF ALL WORLD COUNTRIES (Luxembourg, 2024)

Devianti, Intan Putri, ‘Pengaruh Environment, Social, Dan Governance (ESG) Terhadap Nilai Perusahaan Pada Sektor Pertambangan Yang Terdaftar Di ESG Leaders Indonesia Periode 2017-2022’, Jurnal Ilmu Manajemen, 13.1 (2025), 166–180

Duan, Yiqun, Fan Yang, and Lin Xiong, ‘Environmental, Social, and Governance (ESG) Performance and Firm Value: Evidence from Chinese Manufacturing Firms’, Sustainability (Switzerland), 15.17 (2023)

Hidayat, Muflihun, ‘Adaptasi Industri Nikel Dalam Mencapai Standar Keberlanjutan’, Tambang.Co.Id, 2025

IESR, ‘Indonesia Energy Transition Outlook 2024 IESR Institute for Essential Services Reform’, Indonesia Energy Transition Outlook 2024, 4:2024 (2023), 26–26

Kasmawati, Budiyanto, and Agustedi, ‘The Dividend Policy Moderates the Influence of Liquidity, Solvability, Profitability, and Sales Growth on the Company’s Value’, Journal of World Science, 2.10 (2023), 1529–41

Kementerian PPN/Bappenas, ‘Energi’, Lcdi-Indonesia.Id, 2024 [accessed 2 January 2025]

Makarim, Faiz Firdaus, Tri Kartika Pertiwi, and G. Oka Warmana, ‘Effect of Environmental Social Governance Disclosure on Company Value in the Energy Sector Listed on the Indonesia Stock Exchange’, Indonesian Interdisciplinary Journal of Sharia Economics (IIJSE), 7.3 (2024)

Mudzakir, Fahmi Utomo, and Irene Rini Demi Pangestuti, ‘Pengaruh Environmental, Social and Governance Disclosure Terhadap Nilai Perusahaan Dengan ROA Dan DER Sebagai Variabel Kontrol’, Diponegoro Journal of Management, 12.2 (2023), 1–13

Nashar, Muhammad, Nilda Tartilla, and Wulan Wahyuni Rossa Putri, ‘PENGARUH TAX PLANNING, PROFITABILITAS, DAN LIKUIDITAS TERHADAP NILAI PERUSAHAAN DENGAN BOD DIVERSITY SEBAGAI VARIABEL MODERASI’, SOLUSI : Jurnal Ilmiah Bidang Ilmu Ekonomi, 20.3 (2022), 290–303

Ningwati, Gustin, Ratna Septiyanti, and Neny Desriani, ‘Pengaruh Environment, Social and Governance Disclosure Terhadap Kinerja Perusahaan’, Goodwood Akuntansi Dan Auditing Reviu, 1.1 (2022), 67–78

Nurmutia, Elga, ‘Lewat Kolaborasi, PLN Siap Wujudkan Target 75 GW Pembangkit EBT 2040’, CNBC Indonesia, 2024

Prayogo, Enny, Rini Handayani, and Tiara Meitiawati, ‘ESG Disclosure Dan Retention Ratio Terhadap Nilai Perusahaan Dengan Ukuran Perusahaan Sebagai Pemoderasi’, Reviu Akuntansi Dan Bisnis Indonesia, 7.2 (2023), 368–79

Pristi, Anissa Hafidza, and Muhadjir Anwar, ‘The Effect of Financing Decisions, Investment Decisions, and Asset Manage-Ment Decisions on Company Value with Dividend Policy as Moderating Varia-Ble in Go Public Companies in Indonesia’, 11.1 (2022)

Putri, Debi Eka, and Eka Purnama Sari, ‘Dampak CR, DER Dan NPM Terhadap Tobin`s Perusahaan Sub Sektor Kosmetik Dan Barang Keperluan Rumah Tangga Yang Terdaftar Di BEI’, Jesya (Jurnal Ekonomi & Ekonomi Syariah), 3.2 (2020), 249–55

Putro, Dian Cahyo, and Asep Risman, ‘The Effect of Capital Structure and Liquidity on Firm Value Mediated By Profitability’, The EUrASEANs: Journal on Global Socio-Economic Dynamics, 2.2(27) (2021), 26–34

Rachman, Mochammad Rafi, and Maswar Patuh Priyadi, ‘Pengaruh Profitabilitas, Likuiditas, Dan Leverage Terhadap Nilai Perusahaan Dengan Corporate Social Responsibility Sebagai Variabel Pemoderasi’, Jurnal Ilmu Dan Riset Akuntansi, 11.1 (2022)

Rahelliamelinda, Liangchui, and Jesica Handoko, ‘Profitabiltas Sebagai Moderating Pengaruh Kinerja Esg, Green Innovation, Eco-Efficiency Terhadap Nilai Perusahaan’, Jurnal Informasi, Perpajakan, Akuntansi, Dan Keuangan Publik, 19.1 (2024), 145–70

Ramadhany, Naufal Dzaki, and Rahman Amrullah Suwaidi, ‘Analisis Nilai Perusahaan Pada Perusahaan Tekstil Dan Garmen Yang Terdaftar Di Bursa Efek Indonesia (BEI)’, Jurnal Ilmiah Akuntansi Dan Keuangan, 4.1 (2021)

Ristiani, Lina, and Sri Sudarsi, ‘Analisis Pengaruh Profitabilitas, Likuiditas, Ukuran Perusahaan, Dan Struktur Modal Terhadap Nilai Perusahaan’, Fair Value: Jurnal Ilmiah Akuntansi Dan Keuangan, 5.2 (2022), 837–48

Rohendi, Hendi, Imam Ghozali, and Dwi Ratmono, ‘Environmental, Social, And Governance (ESG) Disclosure And Firm Value: The Role of Competitive Advantage As a Mediator’, Cogent Business and Management, 11.1 (2024)

Safitri, Kiki, and Erlangga Djumena, ‘ESG Bakal Wajib Dalam 2-3 Tahun Lagi, Korporasi Harus Siap Lebih Awal’, KOMPAS.Com, 2024

Sari, Intan Nirmala, ‘Minat Investasi Berkelanjutan (ESG) Naik, OJK Siapkan Roadmap’, Katadata.Co.Id, 2021

Savitri, Anessya Anggia, and Rahman Amrullah Suwaidi, ‘Analisis Nilai Perusahaan Pada Perusahaan Sektor Properties Dan Real Estate Di Bei 1 1,2’, 13.September (2024), 1526–37

Spence, Michael, ‘Job Market Signaling’, The Quarterly Journal of Economics, 87.3 (1973), 355–74

Sutanto, Chrisdian, ‘Literature Review: Pengaruh Inflasi Dan Leverage Terhadap Profitabilitas Dan Return Saham’, Jurnal Ilmu Manajemen Terapan, 2.5 (2021), 589–603

Suwantono, Edwin, and Nopiani Indah, ‘Analisis Pengaruh Struktur Modal, Ukuran Perusahaan Dan Profitabilitas Terhadap Nilai Perusahaan Pada Perusahaan Sektor Energi Yang Terdaftar Di Bursa Efek Indonesia Tahun 2017-2023’, Jurnal Revenue, 5.2 (2025)

Tio, Allend, and Argo Putra Prima, ‘Analisis Pengaruh Kinerja Keuangan Terhadap Nilai Perusahaan Yang Terdaftar Di Bursa Efek Indonesia’, Owner: Riset & Jurnal Akuntansi, 6.1 (2022)

Tirta Wangi, Ghina, and Alfida Aziz, ‘Analisis Pengaruh ESG Disclosure, Likuiditas, Dan Profitabilitas Terhadap Nilai Perusahaan Pada Perusahaan Yang Terdaftar Di Indeks ESG Leaders’, Ikraith-Ekonomika, 7.2 (2024), 221–30

Wahyuni, Putri Dwi, Siska Widia Utami, and Juita Tanjung, ‘The Impact of ESG Disclosure on Firm Value Relevance: Moderating Effect of Competitive Advantage’, European Journal of Accounting, Auditing and Finance Research, 12.8 (2024), 19–33

Waluyo, Djati, ‘Lima Sektor Penyumbang Emisi Terbesar Di Indonesia, Energi Nomor Dua’, Katadata.Co.Id, 2024 [accessed 2 January 2025]

Wicaksono, Ready, and Mispiyanti, ‘Analisis Pengaruh Profitabilitas Dan Kebijakan Dividen Terhadap Nilai Perusahaan Dengan Struktur Modal Sebagai Variabel Mediasi’, Owner: Riset Dan Jurnal Akuntansi, 4.2 (2020), 396–411

Widowati, Hari, ‘Ada Potensi Investasi Triliunan Dolar Untuk Perusahaan Berbasis ESG’, Katadata.Co.Id, 2024

Wikartika, Ira, and Kiky Asmara, ‘The Effect of Financing Decisions , Investment Decisions , and Asset Manage- Ment Decisions on Company Value with Dividend Policy as Moderating Vari- Able in Go Public Companies in Indonesia’, Nusantara Science and Technology Proceedings, 2021

Xaviera, Areta, and Annisaa Rahman, ‘Pengaruh Kinerja Esg Terhadap Nilai Perusahaan Dengan Siklus Hidup Perusahaan Sebagai Moderasi : Bukti Dari Indonesia’, Jurnal Akuntansi Bisnis, 16.2 (2023), 226

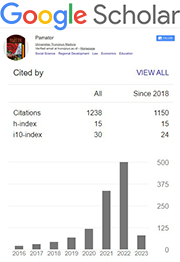

DOI: https://doi.org/10.21107/pamator.v18i2.30092

Refbacks

- There are currently no refbacks.

Copyright (c) 2025 Zakky Rudy Anggara

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Jurnal Pamator : Jurnal Ilmiah Universitas Trunojoyo by Universitas Trunojoyo Madura is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

.png)