STAGFLATION – PROOF BANKING: HOW FINTECH DEVELOPMENT AND FINANCIAL RESILIENCE DRIVE PROFITABILITY – ARDL MODELING EVIDENCE FROM INDONESIA'S COMMERCIAL BANKS

Abstract

This study analyzes the impact of the triple-layer effect stagflation (inflation, GDP), fintech lending, and bank stability (CAR, LDR) on Indonesian banks' ROA, assessing short- and long-term effects. The object of this research is the audited financial report of Indonesian Commercial Bank KBMI IV which is listed on the Indonesia Stock Exchange. Data were collected using purposive sampling (time series of 2019-2024 period). The Autoregressive Distributed Lag (ARDL) model was applied to analyze both short-term dynamics and long-term equilibrium between the variables. The results show that: Inflation has a significant negative impact on ROA in both the short and long term. GDP does not significantly affect ROA. Fintech lending does not have a significant impact on ROA, though it may indirectly pressure banks to innovate. CAR has a significant positive influence on ROA, indicating financial resilience supports profitability. LDR does not significantly affect ROA, suggesting lending activities may not be optimal or are affected by external risks. A long-term cointegration exists between all variables and ROA, indicating the importance of strategic, forward-looking policies. The findings imply that stagflation poses a serious risk to banking profitability. Banks must strengthen risk management, improve capital efficiency, and embrace innovation to remain competitive. Policymakers should support financial stability through appropriate macroeconomic policies, especially in stagflationary conditions.

Full Text:

PDFReferences

Aam, and Dito Prakoso, ‘The Influence of Internal and Macroeconomic Factors on the Profitability of Islamic Commercial Banks in Indonesia’, Ekonomi Islam Indonesia, 3.2 (2021), 2470–79

Abdelmoneim, Zakia, and Mai Yasser, ‘The Impact of Bank Performance and Economic Growth on Bank Profitability: Camel Model Application in Middle-Income Countries’, Banks and Bank Systems, 18.3 (2023), 205–20

Agnes Thandania Blessky, Herlin Munthe, Bayu Wulandari, and Kiki Hardiansyah Siregar, ‘The Effect of Car, Nim, Bopo, and Ldr on Roa in Bumn Banks in the Period 2013-2022’, International Journal of Accounting, Management, Economics and Social Sciences (IJAMESC), 1.5 (2023), 735–44

Alhares, Aws, Abdulrahman Dahkan, and Tarek Abu-Asi, ‘The Effect of Financial Technology on the Sustainability of Banks in the Gulf Cooperation Council Countries’, Corporate Governance and Organizational Behavior Review, 6.4 Special Issue (2022), 359–73

Anggun Wida Prawira, Syamsul Arifin, and Nuryadi, ‘The Impact of Spillover Stagflation on Capital Utilization in East Java (in Macroeconomic Perspectives) 2014-2022’, International Journal of Global Accounting, Management, Education, and Entrepreneurship, 4.1 (2023), 49–59

Annas, Mohammad, Humairoh Humairoh, and Endri Endri, ‘Macroeconomic and Bank-Specific Factors on Non-Performing Loan: Evidence from an Emerging Economy’, Quality - Access to Success, 25.199 (2024), 155–61

Aryasari, Mela, and Bahtiar Usman, ‘Exploring the Impact of Digital Transformation and Banking Factors on the Financial Performance of Conventional Banks Listed on the Indonesian Stock Exchange’, Jurnal Ekonomi, Bisnis & Entrepreneurship, 18.October (2024), 733–56

Ashhari, Wang Haoliang1 Mohamed Hisham Dato Haji Yahya2* Norhuda Abdul Rahim3 Zariyawati Mohd, ‘The Impact of Fintech on the Profitability of State-Owned Commercial Banks in China’, Journal of Physics: Conference Series, 1955.1 (2021), 128–38

Ayu Levia Tryana, ‘Profitability in State-Owned Enterprises Banks Listed on the Indonesian Stock Exchange 2019-2023 as an Effect of CAR, TATO, and NPL’, ECo-Fin, 6.2 (2024), 226–35

Bakkara, Lesdon, and Ronny B Sihotang, ‘THE EFFECT OF BANKING DIGITALIZATION ON RETURN ON ASSETS AND RETURN ON EQUITY IN KBMI IV BANKING COMPANIES LISTED ON THE INDONESIAN STOCK EXCHANGE Pengaruh Digitalisasi Perbankan Terhadap Return On Assets Dan Return On Equity Pada Perusahaan Perbankan Kbm’, COSTING:Journal of Economic, Business and Accounting, 7.3 (2024), 6260–70

Baltussen, Guido, Laurens Swinkels, Bart van Vliet, and Pim van Vliet, ‘Investing in Deflation, Inflation, and Stagflation Regimes’, Financial Analysts Journal, 79.3 (2023), 5–32

Benigno, Pierpaolo, Paolo Canofari, Giovanni Di Bartolomeo, and Marcello Messori, ‘Stagflation and Fragmentation : The Euro Area at the Crossroads’, … Monetary Affairs, Policy …, 2022

Claessens, Stijn, and M. Ayhan Kose, Frontiers of Macrofinancial Linkages, BIS Papers, 2018, XCV

Coryanata, Isma, Elisa Hawalia Ramli, Lisa Martiah Nila Puspita, and Halimatusyadiah Halimatusyadiah, ‘Digitalization of Banking and Financial Performance of Banking Companies’, International Journal of Social Service and Research, 3.2 (2023), 366–71

Dana Moneter Internasional, ‘World Economic Outlook: Global Economic Prospects’, World Economic Outlook Update, 1 (2023), 2

Destiara, Kenji, ‘Analisis Dinamika Makro Ekonomi Indonesia Terhadap Return On Asset Pada Bank Umum Devisa Dengan Loan To Deposit Ratio Sebagai Variabel Intervening Pasca Krisis Ekonomi Global Abstract This Study Aims to Analyze the Influence of Indonesia ’ s Macroeconomi’, Riset Perbankan Manajemen Dan Akuntansi, 2022, 1–11

Dewi, Anggi Putri, Shantika Martha, and Hendra Perdana, ‘Model Autoregressive Distributed Lag Dengan Metode Koyck’, Buletin Ilmiah Math. Stat. Dan Terapannya (Bimaster), 12.01 (2023), 89–96

Digdowiseiso, Kumba, Metode Penelitian Ekonomi Dan Bisnis, Universitas Nasional (Jakarta Selatan: Lembaga Penerbitan Universitas Nasional (LPU-UNAS), 2017), I

Doǧan, Mesut, and Feyyaz Yildiz, ‘Testing the Factors That Determine the Profitability of Banks with a Dynamic Approach: Evidence from Turkey’, Journal of Central Banking Theory and Practice, 12.1 (2023), 225–48

European Parliament, ‘Interaction between Price Stability and Financial Stability’, Economic Governance and EMU Scrutiny Unit (EGOV), June, 2023

Fatihudin, D, METODE PENELITIAN UNTUK ILMU EKONOMI, MANAJEMEN DAN AKUNTANSI Dari Teori Ke Praktek, Zifatama Publisher, 1st edn (Sidoarjo: Zifatama Publisher, 2020)

Gazi, Md Abu Issa, Rejaul Karim, Abdul Rahman bin S. Senathirajah, A. K.M.Mahfuj Ullah, Kaniz Habiba Afrin, and Md Nahiduzzaman, ‘Bank-Specific and Macroeconomic Determinants of Profitability of Islamic Shariah-Based Banks: Evidence from New Economic Horizon Using Panel Data’, Economies, 12.3 (2024)

Ghafel, Omar Abderrahmane, and Khemaies Bougatef, ‘The Impact of Inflation on Bank Profitability: Empirical Evidence from Iraq’, Pakistan Journal of Life and Social Sciences, 22.2 (2024), 1599–1607

Girdzijauskas, Stasys, Dalia Streimikiene, Ingrida Griesiene, Asta Mikalauskiene, and Grigorios L. Kyriakopoulos, ‘New Approach to Inflation Phenomena to Ensure Sustainable Economic Growth’, Sustainability (Switzerland), 14.1 (2022), 1–21

Gunanto, Adi, ‘Internal Variables and Macroeconomic Factors as Determinants of Profitability in Islamic Banking Indonesia’, Futurity Economics&Law, 3 (2023), 48–66

Hermawan, Sigit, and Wiwit Hariyanto, Buku Ajar Metode Penelitian Bisnis (Kuantitatif Dan Kualitatif ), Buku Ajar Metode Penelitian Bisnis (Kuantitatif Dan Kualitatif ), Cetakan Pe (Sidoarjo: UMSIDA Press Redaksi, 2022)

Hernawati, Heni, Dedi Hariyanto, and Heni Safitri, ‘The Effect Of CAR, NPL And BOPO On ROA With LDR As Intervening Variable’, EAI Inovating Research, 2024

Islam, Mohammed Rakibul, ‘The Impact of Macroeconomic Factors on Profitability of Commercial Bank in the UK’, International Journal For Multidisciplinary Research, 5.1 (2023), 1–19

Jamal, Surayya, Zulfiqar Ali, Muhammad Ayaz Khan, and Syed Ajmal Shah, ‘Advancing in the Change Journey Towards FinTech : Does the Financial Performance of Commercial Banks in Pakistan Increase ?’, Journal for Social Science Archives, 3.1 (2025), 43–55

Jameaba, Muyanja, ‘Digitalization, Emerging Technologies, and Financial Stability: Challenges and Opportunities for the Indonesian Banking Sector and Beyond’, SSRN Electronic Journal, February, 2024, 1–39

Jarah, Baker Akram Falah, Mohammad Yousef Alghadi, Murad Ali Ahmad Al-Zaqeba, Mohamed Ibrahim Mugableh, and Belal Zaqaibeh, ‘The Influence of Financial Technology on Profitability in Jordanian Commercial Banks’, Humanities and Social Sciences Letters, 12.2 (2024), 176–88

Jigeer, Shawuya, and Ekaterina Koroleva, ‘The Determinants of Profitability in the City Commercial Banks: Case of China’, Risks, 11.3 (2023)

Junarsin, Eddy, Rizky Yusviento Pelawi, Jordan Kristanto, Isaac Marcelin, and Jeffrey Bastanta Pelawi, ‘Does Fintech Lending Expansion Disturb Financial System Stability? Evidence from Indonesia’, Heliyon, 9.9 (2023), e18384

Karadayi, Nilgun, ‘The Effect of Loan to Deposit Ratio(LDR), Non-Performing Loan(NPL), Other Operating Expenses, and Non-Interest Income on Profitability(ROA)’, International Journal of Scientific and Research Publications (IJSRP), 13.1 (2023), 389–97

Khai Nguyen, Quang, and Van Cuong Dang, ‘The Effect of FinTech Development on Financial Stability in an Emerging Market: The Role of Market Discipline’, Research in Globalization, 5.November (2022), 100105

Khan, Shoaib, ‘Determinants of Banks Profitability: An Evidence from GCC Countries’, Journal of Central Banking Theory and Practice, 11.3 (2022), 99–116

Laloan, Eka Elencya Trisilia, Nelson Nainggolan, and Djoni Hatidja, ‘Penerapan Autoregressive Distributed Lag (ARDL) Dalam Memodelkan Pengaruh Lama Sekolah Dan Tingkat Pengangguran Terbuka Terhadap Kemiskinan Di Kota Manado’, D’Cartesian, 12.2 (2023), 35–40

de Leon, Myra V., ‘The Impact of Credit Risk and Macroeconomic Factors on Profitability: The Case of the ASEAN Banks’, Banks and Bank Systems, 15.1 (2020), 21–29

Mulyani, Rita, Retno Fuji Oktaviani, and Nurul Khansa Fauziyah, ‘The Effect of Key Financial Indicators on Bank Profitability’, Shafin: Sharia Finance and Accounting Journal, 5.1 (2025), 96–110

Murtiningrum, Widiastuti, and Erna Wahyuningsih, ‘Analysis of the Effect of Financial Ratios on ROA at Commercial Banks on the IDX’, Asean International Journal of Business, 3.1 (2024), 12–19

Nguyen-Thi-Huong, Lan, Hung Nguyen-Viet, Anh Nguyen-Phuong, and Duy Van Nguyen, ‘How Does Digital Transformation Impact Bank Performance?’, Cogent Economics and Finance, 11.1 (2023)

Novalina, Ade, Ramli Ramli, Murni Daulay, and Dede Ruslan, ‘Economic Recession in 7Em Countries: Evidence of 3P Capability and Impact of Covid-19’, International Journal of Economic, Technology and Social Sciences (Injects), 2.1 (2021), 351–68

Ilma Nurinfiaa, and Yenie Eva Damayanti, ‘Effect of Capital Adequacy Ratio (CAR), Net Interest Margins (NIM), and Loans to Deposit Ratio (LDR) On Profitability (Case Study in Banking Companies Listed on the Exchange Effect Indonesia Period 2017-2019)’, International Journal of Multidisciplinary Research and Analysis, 06.01 (2023), 280–87

Obeid, Rami, ‘Factors Affecting Return on Assets (ROA) in the Banking Sector of Selected Arab Countries: Is There a Role for Financial Inclusion and Technology Indicators?’, International Journal of Economics and Finance, 15.9 (2023), 1

OJK, ‘Penguatan Sektor Jasa Keuangan Dalam Menjaga Pertumbuhan Ekonomi: Laporan Kinerja OJK Tahun 2023’, Financial Services Authority (FSA), 2024

Onorato, Grazia, Francesca Pampurini, and Anna Grazia Quaranta, ‘Lending Activity Efficiency. A Comparison between Fintech Firms and the Banking Sector’, Research in International Business and Finance, 68.September 2023 (2024), 102185

Pada, Studi, Otoritas Jasa, and Elsa Dwi, ‘PENGARUH DIGITAL BANKING , FINTECH PAYMENT , DAN FINTECH LENDING TERHADAP KINERJA KEUANGAN PERBANKAN’, Jurnal Akuntansi, Keuangan, Perpajakan Dan Tata Kelola Perusahaan (JAKPT), 2.1 (2024), 51–58

Panglipursari, D W I Lesno, T R I Ratnawati, and Ulfi Pristiana, ‘Reinforcing Indonesian Banks ’ Earnings Stability : A Analysis of Profile , Bank Digitalization , and Fintech P2P Lending’, The Seybold Report, January, 1945, 440–53

Panglipursari, Dwi Lesno, Tri Ratnawati, and Ulfi Pristiana, ‘The Effect of Digitalization of Banks and Fintech Peer to Peer Lending on Earning with Variable Intervening Liquidity Risk’, Proceeding International Conference on Economic Business Management, and Accounting (ICOEMA)-2022, 2022, 783–94

Paukmongkol, Wikrant, ‘Determinants of Bank Profitability in Thailand by Generalized Method of Moments Estimation’, Asia Social Issues, 1 (2023), e260597

Pejčić, Jovica, Marina Beljić, and Olgica Glavaški, ‘Global Stagflationary Pressures: Macroeconomic Repercussions of Pandemic and Geopolitical Crises’, Ekonomija: Teorija i Praksa, 26.2 (2023), 98–117

Pertiwi, Silva Nurbaiti, Jamaludin Jamaludin, Ignatius Henry Wicaksono, Henny Setyo Lestari, and Farah Margaretha Leon, ‘The Effect Of Digitization Transformation On Financial Performance: A Case Study Of Banking Companies In Indonesia’, Journal Research of Social Science, Economics, and Management, 3.3 (2023), 620–35

Prawira, Anggun Wida, and Syamsul Arifin, ‘Pengaruh Jerat Stagflasi Pada Capaian Laju Investasi Di Provinsi Jawa Timur Periode 2019-2022’, Journal of Business and Economics Research (JBE), 4.2 (2023), 164–73

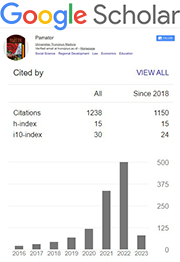

Prawira, Anggun Wida, and Heni Susilowati, ‘ASSESSING HOW FINTECH PEER-TO-PEER LENDING , BANKING DIGITIZATION , AND BANKING CREDIT RISK AFFECT THE FINANCIAL PERFORMANCE OF INDONESIAN COMMERCIAL BANKS KBMI 4 IN DIGITAL ERA’, JURNAL PAMATOR, 17.4 (2024), 620–38

Rifansa, Muhammad Budi, Nur Aisyah, and F Pulungan, ‘The Effect of Capital Adequacy Ratio (CAR), Non-Performing Loan (NPL), Net Interest Margin (NIM), Loan to Deposit Ratio (LDR) and Operational Costs and Operational Revenue (BOPO) On Return on Assets (ROA) in Bank IV Indonesia’, Budapest International Researchand Critics Institute-Journal (BIRCI-Journal, 5.2 (2022), 15723–37

Salsabila, Zahra, Eka Wulan Rhamdani, Alfina Naufali Putri, and Acep Komara, ‘The Impact of Lending Growth and Financial Statistics on Bank Profitability : The Moderating Role of Credit Risk’, International Journal of Business, Economics, and Social Development, 5.2 (2024), 251–59

Sharma, Hemlata, Aparna Andhalkar, Oluwaseun Ajao, and Bayode Ogunleye, ‘Analysing the Influence of Macroeconomic Factors on Credit Risk in the UK Banking Sector’, Analytics, 3.1 (2024), 63–83

Sukmana, Rania, ‘Pemodelan Autoregressive Distributed Lag Untuk Memprediksi Nilai Impor Non-Migas Di Indonesia’, JURNAL STATISTIKA UNIVERSITAS DIPONEGORO, 13 (2025), 499–508

Suparmun, Haryo, and Wilhelmus Hary Susilo, Metode Penelitian Bisnis (Aplikasi Pendekatan Manajemen Berbasis-Pasar), In Media (Bogor: Penerbit IN MEDIA, 2020)

Vinsensius Agus Rakadewa, Sri Dwi Ari Ambarwati, Khoirul Hikmah, ‘Analysis of the Effect of BOPO, CAR, DPK, LDR, and NPL on the Financial Performance of Banking Companies on the IDX 2021-2023’, Journal of Multidisciplinary Science, 2.1 (2025), 141–52

Vuong, Giang Thi Huong, Yen Dang Hai Nguyen, Manh Huu Nguyen, and Wing Keung Wong, ‘Assessing the Impact of Macroeconomic Uncertainties on Bank Stability: Insights from ASEAN-8 Countries’, Heliyon, 10.11 (2024), e31711

Wahyuni, Sri, Abiyajid Bustami, Rinna Ramadhan Ain Fitriah, Muh Shadiqul Fajri Af, and Rizky Yudaruddin, ‘The Impact of Fintech Peer-to-Peer Lending and Islamic Banks on Bank Performance during COVID-19’, Banks and Bank Systems, 19.1 (2024), 195–207

Wiadnyani, Dewa Ayu Putu Mas, and Luh Gede Sri Artini, ‘Influence of NPL, BOPO, LDR, and ROA on Firm Value: Study of Banking Sub-Sector Companies on the Indonesia Stock Exchange 2019-2021’, European Journal of Business and Management Research, 8.4 (2023), 261–66

Yuan, Deli, Md Abu Issa Gazi, Iman Harymawan, Bablu Kumar Dhar, and Abu Ishaque Hossain, ‘Profitability Determining Factors of Banking Sector: Panel Data Analysis of Commercial Banks in South Asian Countries’, Frontiers in Psychology, 13 (2022)

Yudaruddin, Rizky, wahyoe soedarmono, Bramantyo Adi Nugroho, Zhikry Fitrian, Mardiany Mardiany, Adi Hendro Purnomo, and others, ‘Financial Technology and Bank Stability in an Emerging Market Economy’, Heliyon, 9.5 (2023), e16183

Yun Li, ‘Digital Lending and Bank Profitability in Selected Asian Countries’, Journal of Business and Management Studies, 1 (2025), 15–21

DOI: https://doi.org/10.21107/pamator.v18i2.29734

Refbacks

- There are currently no refbacks.

Copyright (c) 2025 Anggun Wida Prawira, Siti Mujanah, Achmad Yanu Alif Fianto

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Jurnal Pamator : Jurnal Ilmiah Universitas Trunojoyo by Universitas Trunojoyo Madura is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

.png)