The Effect of Profitability, Good Corporate Governance, and Environmental Disclosure on Firm Value in Mining Companies Listed on The Indonesia Stock Exchange

Abstract

Keywords

Full Text:

PDFReferences

Agung, A., Laksmi, S. D., Gusti, N., & Wirawati, P. (2022). Profitabilitas, Good Corporate Governance, Pengungkapan Corporate social responsibility dan Nilai Perusahaan. E-Jurnal Akuntansi, 32 No. 4, 1046–1056. https://doi.org/10.24843/EJA.2022.v

corporatefinanceinstitute.com. (2023, January 15). Q Ratio. https://corporatefinanceinstitute.com/resources/valuation/q-ratio/

eiti.esdm.go.id. (2017). Industri Tambang Penopang Perekonomian. https://eiti.esdm.go.id/industri-tambang-penopang-perekonomian/

ekbis.sindonews.com. (2022). Digas Harga Komoditas, PNBP Sektor Tambang Tembus Rp173,5 Triliun. https://ekbis.sindonews.com/read/982411/34/digas-harga-komoditas-pnbp-sektor-tambang-tembus-rp1735-triliun-1672312328

Fadillah, A. N., & Susilowati, E. (2023). Pengaruh Ukuran Perusahaan Terhadap Nilai Perusahaan Dengan Sustainability Report Sebagai Variabel Mediasi. JEMASI: Jurnal Ekonomi Manajemen Dan Akuntansi, 19(1), 1–14.

Fasya, D., & Hidayat, N. (2021). Pengaruh pengungkapan corporate social responsibility, good corporate governance, profitabilitas dan ukuran perusahaan terhadap nilai perusahaan. https://journal.unimma.ac.id

Febriyanti, A., & Sulistyowati, E. (2021). Pengaruh Firm Size, Sales Growth, Dan Return On Equity Terhadap Firm Value Pada Perusahaan Manufaktur. Jurnal Maneksi, 10, 103–1011.

Fidiawati, & Sulistyowati, E. (2022). Analisis Pengaruh Good Corporate Governance dan Ukuran Perusahaan terhadap Kinerja Keuangan Perusahaan pada Perusahaan Manufaktur Sektor Industri Barang Konsumsi yang Terdaftar di Bursa Efek Indonesia Tahun 2018-2020 (Vol. 4). www.idx.co.id.

Indrawati, Y. Y. D., & Sulistyowati, E. (2022). Pengaruh Good Corporate Governance (GCG) Dan Corporate Social Responsibility (CSR) Terhadap Nilai Perusahaan pada Perusahaan Manufaktur Sektor Industri Barang dan Konsumsi Yang Terdaftar di Bursa Efek Indonesia Tahun 2016-2020 (Vol. 4).

investasi.kontan.co.id. (2020a). Indeks sektor pertambangan naik 13,48% sejak awal tahun, simak rekomendasi analis. https://investasi.kontan.co.id/news/indeks-sektor-pertambangan-naik-1348-sejak-awal-tahun-simak-rekomendasi-analis

investasi.kontan.co.id. (2020b). Sepanjang 2019 sektor pertambangan turun drastis, begini prospeknya di 2020. https://investasi.kontan.co.id/news/sepanjang-2019-sektor-pertambangan-turun-drastis-begini-prospeknya-di-2020?page=all

Kawi, Y. A. S., & Natalylova, K. (2022). Pengaruh Environmental Disclosure, Social Disclosure, Profitabilitas, Dan Faktor Lain Terhadap Nilai Perusahaan (Vol. 2, Issue 3). http://jurnaltsm.id/index.php/EJATSM

Muasiri, A. H., & Sulistyowati, E. (2021). Pengaruh Intelectual Capital Dan Corporate Governance Terhadap Nilai Perusahaan Dengan Profitabilitas Sebagai Variabel Moderasi. Jurnal Ekonomi Dan Bisnis (EK&BI), 4(1), 426–436. https://doi.org/10.37600/ekbi.v4i1.255

Nathanael, G. K. (2021). Industri Batubara Dari Sisi Ekonomi, Politik, dan LingkunganI (Vol. 2, Issue 1).

Nursasi, E., & Nurdanna Faizah, A. (2022). Pengaruh Profitabilitas Dan Good Corporate Governance Terhadap Nilai Perusahaan. Jurnal Manajemen Dirgantara, 15(2), 319–328. https://doi.org/10.56521/manajemen-dirgantara.v15i2.769

Ramadhan, R. P., & Sulistyowati, E. (2022). Pengaruh Corporate Social Responsibility terhadap Kinerja Keuangan dengan Nilai Perusahaan sebagai Variabel Mediasi.

Ramdhonah, Z., Solikin, I., & Sari, M. (2019). Pengaruh Struktur Modal, Ukuran Perusahaan, Pertumbuhan Perusahaan, Dan Profitabilitas Terhadap Nilai Perusahaan (Studi Empiris Pada Perusahaan Sektor Pertambangan Yang Terdaftar Di Bursa Efek Indonesia Tahun 2011-2017). Jurnal Riset Akuntansi Dan Keuangan, 7(1), 67–82.

Sari, D. M., & Wulandari, P. P. (2021). Pengaruh Kepemilikan Institusional, Kepemilikan Manajerial, Dan Kebijakan Dividen Terhadap Nilai Perusahaan. Tema (Jurnal Tera Ilmu Akuntansi), 22, 1–18.

Suhara, O. N., & Susilowati, E. (2022). Pengaruh Kinerja Keuangan Memediasi GCG Terhadap Nilai Perusahaan pada Perusahaan Perbankan yang terdaftar di BEI Tahun 2015-2019. Jurnal Pendidikan Dan Konseling, 4(4), 5426–5436.

Thauziad, S., & Kholmi, M. (2021). Pengaruh Good Corporate Governance, Profitabilitas dan Kebijakan Dividen terhadap Nilai Perusahaan. Jurnal Mutiara Akuntansi, 6(2), 186–200. https://doi.org/10.51544/jma.v6i2.2136

Wardhani, W. K., Titisari, K. H., & Suhendro, S. (2021). Pengaruh Profitabilitas, Struktur Modal, Ukuran Perusahaan, Dan Good Corporate Governance terhadap Nilai Perusahaan. Ekonomis: Journal of Economics and Business, 5(1), 37–45. https://doi.org/10.33087/ekonomis.v5i1.264

www.cnbcindonesia.com. (2021). Industri Kesehatan & Tambang Jadi Juara di Kuartal III-2021. https://www.cnbcindonesia.com/news/20211105105459-4-289231/industri-kesehatan-tambang-jadi-juara-di-kuartal-iii-2021

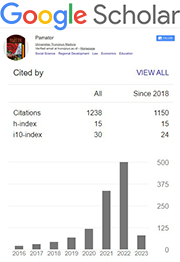

DOI: https://doi.org/10.21107/pamator.v16i3.22079

Refbacks

- There are currently no refbacks.

Copyright (c) 2023 Muhammad Alfin Yusra, Erna Sulistyowati

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Jurnal Pamator : Jurnal Ilmiah Universitas Trunojoyo by Universitas Trunojoyo Madura is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

.png)