THE EFFECT OF ENVIRONMENTAL, SOCIAL, AND GOVERNANCE (ESG) DISCLOSURE ON THE COMPANY'S MARKET VALUE IN INDONESIA

Abstract

Keywords

Full Text:

PDFReferences

Abu-Alkheil, Ahmad, Ghadeer M. Khartabiel, and Manuel Salazar Fernández. 2019. ‘Do German Green Mutual Funds Perform Better Than Their Peers’, Business and Economics Research Journal, 10.2: 297–312

Albuquerque, Rui, Yrjö Koskinen, and Chendi Zhang. 2019. ‘Corporate Social Responsibility and Firm Risk: Theory and Empirical Evidence’, Management Science, 65.10: 4451–69

Aryani, Dian, and Puji Muniarty. 2020. ‘Perbandingan Gross Profit Margin PT Mayora Indah Dengan PT Nippon Indosari Corpindo’, Pamator Journal, 13.1: 150–53

Atif, Muhammad, and Searat Ali. 2021. ‘Environmental, Social and Governance Disclosure and Default Risk’, Business Strategy and the Environment, 30.8: 3937–59

Branco, Manuel Castelo, and Lúcia Lima Rodrigues. 2006. ‘Corporate Social Responsibility and Resource-Based Perspectives’, Journal of Business Ethics, 69.2: 111–32

Buchanan, Bonnie, Cathy Xuying Cao, and Chongyang Chen. 2018. ‘Corporate Social Responsibility, Firm Value, and Influential Institutional Ownership’, Journal of Corporate Finance, 52: 73–95

Cheng, Louis T.W., Shu Kam Lee, Sung Ko Li, and Chun Kei Tsang. 2023. ‘Understanding Resource Deployment Efficiency for ESG and Financial Performance: A DEA Approach’, Research in International Business and Finance, 65: 101941

Fatemi, Ali, Iraj Fooladi, and Hassan Tehranian. 2015. ‘Valuation Effects of Corporate Social Responsibility’, Journal of Banking & Finance, 59: 182–92

Garcia, Alexandre Sanches, Wesley Mendes-Da-Silva, and Renato J. Orsato. 2017. ‘Sensitive Industries Produce Better ESG Performance: Evidence from Emerging Markets’, Journal of Cleaner Production, 150: 135–47

Li, Yiwei, Mengfeng Gong, Xiu-Ye Zhang, and Lenny Koh. 2018. ‘The Impact of Environmental, Social, and Governance Disclosure on Firm Value: The Role of CEO Power’, The British Accounting Review, 50.1: 60–75

Naeem, Nasruzzaman, Serkan Cankaya, and Recep Bildik. 2022. ‘Does ESG Performance Affect the Financial Performance of Environmentally Sensitive Industries? A Comparison between Emerging and Developed Markets’, Borsa Istanbul Review, 22: S128–40

Pozzoli, Matteo, Alessandra Pagani, and Francesco Paolone. 2022. ‘The Impact of Audit Committee Characteristics on ESG Performance in the European Union Member States: Empirical Evidence before and during the COVID-19 Pandemic’, Journal of Cleaner Production, 371: 133411

Ren, Xiaohang, Gudian Zeng, and Yang Zhao. 2023. ‘Digital Finance and Corporate ESG Performance: Empirical Evidence from Listed Companies in China’, Pacific-Basin Finance Journal, 79: 102019

Rjiba, Hatem, Abderrahman Jahmane, and Ilyes Abid. 2020. ‘Corporate Social Responsibility and Firm Value: Guiding through Economic Policy Uncertainty’, Finance Research Letters, 35: 101553

Rutjuhan, Arta, and Ismunandar Ismunandar. 2020. ‘Pengaruh Fasilitas Dan Lokasi Terhadap Kepuasan Pelanggan : Studi Kasus Mahfoed Life Gym’, Pamator Journal, 13.1: 105–9

Sukardi, Sukardi, Syaiful Bahri, and Zulaspan Tupti. 2020. ‘Pengaruh Kepemimpinan, Lingkungan Dan Budaya Terhadap Kepuasan Kerja Pegawai Umum Dan Perlengkapan Labura’, Pamator Journal, 13.1: 118–24

Wong, Jin Boon, and Qin Zhang. 2022. ‘Stock Market Reactions to Adverse ESG Disclosure via Media Channels’, The British Accounting Review, 54.1: 101045

Wong, Woei Chyuan, Abd Halim Ahmad, Shamsul Bahrain Mohamed-Arshad, Sabariah Nordin, and Azira Abdul Adzis. 2022. ‘Environmental, Social and Governance Performance: Continuous Improvement Matters’, Malaysian Journal of Economic Studies, 59.1: 49–69

Wong, Woei Chyuan, Jonathan A. Batten, Abd Halim Ahmad, Shamsul Bahrain Mohamed-Arshad, Sabariah Nordin, and others. 2021. ‘Does ESG Certification Add Firm Value?’, Finance Research Letters, 39: 101593

Wu, Junjie, George Lodorfos, Aftab Dean, and Georgios Gioulmpaxiotis. 2017. ‘The Market Performance of Socially Responsible Investment during Periods of the Economic Cycle - Illustrated Using the Case of FTSE’, Managerial and Decision Economics, 38.2: 238–51

Yu, Ellen Pei-yi, Christine Qian Guo, and Bac Van Luu. 2018. ‘Environmental, Social and Governance Transparency and Firm Value’, Business Strategy and the Environment, 27.7: 987–1004

Zumente, Ilze, and Nataļja Lāce. 2021. ‘ESG Rating—Necessity for the Investor or the Company?’, Sustainability, 13.16: 8940

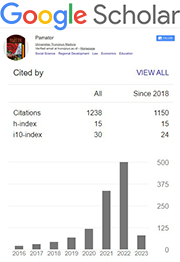

DOI: https://doi.org/10.21107/pamator.v16i3.19923

Refbacks

- There are currently no refbacks.

Copyright (c) 2023 Atika Kusuma Dewi

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Jurnal Pamator : Jurnal Ilmiah Universitas Trunojoyo by Universitas Trunojoyo Madura is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

.png)